Latest News

- Hyundai E&C Shifts into High Gear to Enter Nordic Large-Scale Nuclear Market

- Hyundai E&C Strengthens Korea-Japan Cooperation in Energy Transition and New Growth Businesses

- Hyundai E&C Signals Green Light for Large-Scale Nuclear Power Plant Business in Europe

- Hyundai E&C Unveils Energy-driven Growth Strategy “H-Road”

- Hyundai E&C to Build First Unit of SMR-300, a Model for U.S.-Korea Energy Cooperation

How Can Korean Construction Companies Improve Global Competitiveness by 2025?

■ Overseas orders exceed 30 billion USD for five consecutive years - will 2025 be a rosy year?

According to the International Contractors Association of Korea(ICAK), the total number of overseas orders secured by Korean construction companies this year stands at 525, with a cumulative value of 32.69 billion USD as of the end of November. This represents an increase of 18% over the same period last year (27.73 billion USD and is also 32.5% higher than the five-year average of approximately 24.82 billion USD Despite challenges such as high inflation, high interest rates and high exchange rates, South Korea's construction industry has achieved more than 30 billion USD in overseas orders for five consecutive years. However, concerns remain due to rapidly changing domestic and international conditions, raising questions about how long this upward trend can be sustained.

.jpg)

According to IHS Markit (Oct 2024), a global market intelligence company, the global construction market is expected to reach 15.62 trillion USD in 2025, an increase of 6.4% from this year. The market is expected to continue growing, driven by factors such as public infrastructure investment policies implemented by various countries. The Middle East remains the only region with double-digit growth (11.8%), driven by its oil money. Africa, which has been sluggish due to the global high-interest rate environment, is also expected to grow by 9.9%. In addition, large projects focused on transportation infrastructure are expected to thrive in Asia, while Europe is expected to see growth in the green energy sector. In Latin America, projects to upgrade aging infrastructure are expected to gain momentum.

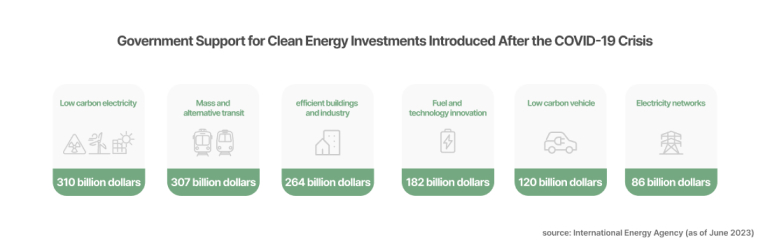

■ The Environmentally Friendly Energy Market to Gain from Increased Government Investments

.jpg)

The most significant change in energy policy is expected to take place in the US. Despite the possibility of a sudden reversal of environmental policy under "Trumponomics 2.0”, the global energy transition is projected to continue next year. According to a study by the International Energy Agency (IEA), global electricity generation from renewable energy will triple by 2030, while investment in power grids will double. Meanwhile, power generation from fossil fuels is expected to decline by 95% by 2040 and be gradually phased out. This is why many expert organizations predict that Trump's policies are unlikely to alter the global energy transition trend.

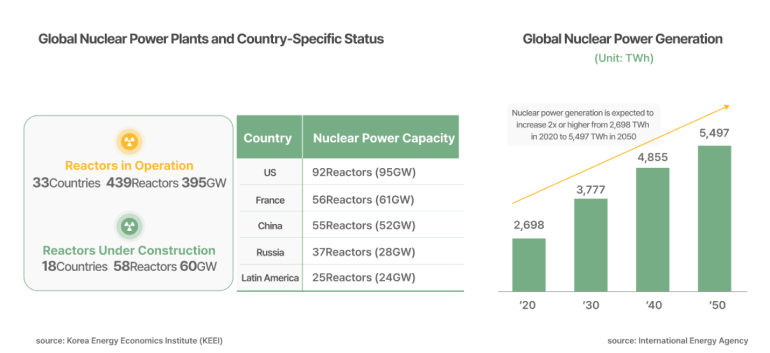

■ Global Nuclear Power Market Back in the Spotlight

[ Indian Point Nuclear Power Plant in the US, where Hyundai E&C is collaborating with Holtec International on a nuclear decommissioning project, the first such initiative by a Korean builder ]

The nuclear power plant industry, where Korean builders have a competitive edge, is expected to expand further next year. As nuclear power gains attention as an alternative solution to power shortages caused by the explosive growth of the digital industry and the energy transition, demand is expected to increase in many countries. Currently, reactors over 30 years old account for 66% of the world's nuclear power generation, which is likely to accelerate various related businesses, including construction of new nuclear power plants, life extension of existing plants, decommissioning of old reactors, and development of spent nuclear fuel facilities.

■ The Oil & Gas Market Poised for Its Largest Expansion Ever

The oil and gas market, which was severely impacted during the COVID-19 pandemic, is expected to regain momentum next year. According to market research firm GlobalData, global oil and gas projects reached a record high of 399.7 billion USD this year, surpassing the previous high of 393.2 billion USD in 2014. There are even predictions that the market could grow to 447 billion USD by 2028.

Regionally, the Asia-Pacific and Middle East-Africa markets are expected to drive growth with an average annual growth rate of 5%. The US, which has already secured the largest market with its active LNG business, is also expected to maintain its strong position in the oil and gas sector. During the election campaign, President-elect Trump repeatedly emphasized "Drill, baby, drill," reaffirming his strong commitment to loosening regulations on oil and gas production while increasing support for the fossil fuel industry. This policy shift is likely to boost oil production in the short term, but it could also affect the production plans of major oil producing and exporting countries, including OPEC, so it is important to keep a close eye on the international crude oil market.

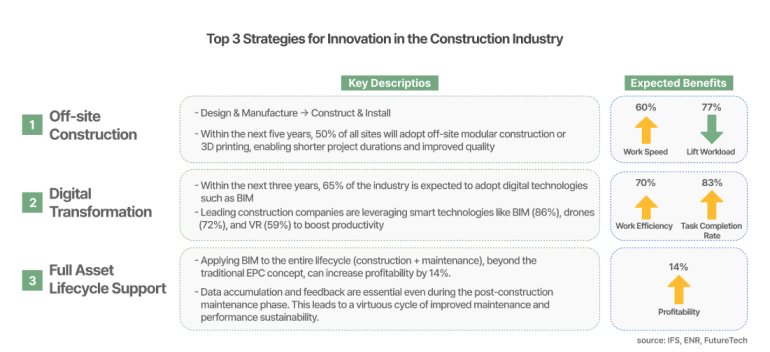

■ The Con-Tech Market Driving Profitability in Construction Sites

IT company IFS and construction magazine ENR have identified the following future smart technologies expected to drive innovation in the construction industry: ▲ Off-Site Construction (OSC), ▲ Digital Twin/Digital Transformation, and ▲ Building Information Modeling (BIM) applied throughout the full project lifecycle. Leading global construction firms such as Bechtel, Fluor, and Jacobs are extending digital technology into construction, safety, and operations. As a result, they are benefiting from increased productivity in the construction industry, improved safety incident prevention, and streamlined maintenance processes. South Korea is also making strong efforts to promote smart construction, with the Ministry of Land, Infrastructure, and Transport announcing “The S-Construction 2030” initiative and launching the “Smart Construction Alliance”. Additionally, many companies are expanding BIM design, adopting AI-based site management, and developing new off-site technologies to enhance the quality and safety of construction sites.